4 min read

Is Your Firm Compensating Staff on Firm Performance? Maybe It Should

Let’s start with a truth bomb: You pay your team to perform—but are you rewarding them for the firm’s performance?

...

The primary point of contact to be tagged in the Portal with all tasks and documentation requests is specified by the Partner for each client during scoping.

An additional point of contact for each client to upload bank statements may also be specified by the Partner for each client during scoping, if applicable.

Deployment Inquiries: @deployment in the Portal

Accounting Related Inquiries: @accountant in the Portal

The following services will be delivered, based on the services scoped for a given client:

Deposits will be categorized to revenue accounts or matched to customer payments previously recorded and applied by the client (must be exact 1:1 match)

Expenses will be categorized to expense accounts or matched to vendor payments previously recorded by the client (must be exact 1:1 match)

Bank & Credit Card Reconciliations

Generate Standard Balance Sheet, Income Statement, & Statement of Cash Flow

Overall Book Review for any unusual balances or discrepancies

Payroll Adjustment - manage Payroll transactions according to payroll schedule via provider integration or journal entry

Includes Basic Services, plus any combination of the following, based on the services scoped for a given client:

Autonomous AP bills on a weekly cadence established during scoping of a client

Record payments and deposits against the appropriate invoice(s) and/or customer(s) in the GL

Assignment of classes or departments during transaction categorization

All allocations are made on a 1:1 class or department basis, except for payroll

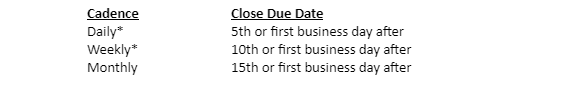

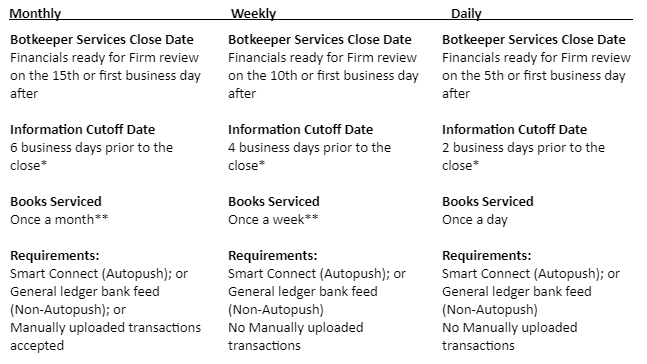

There are 3 levels of bookkeeping frequency (cadences) available for both the Basic and Advanced Service that correspond with a monthly closing date and carry a different monthly cost, as follows. The cadence is to be indicated for each client during scoping:

*There are special requirements to qualify for daily or weekly cadence, which are as follows:

No need for manually uploaded transactions

Connected bank and credit card feeds to GL (closely being monitored for disconnection)

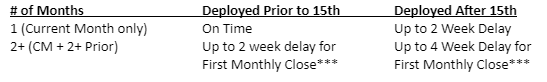

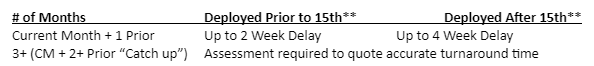

In order to ensure a timely first close, all required information* should be provided no later than 2 business days prior to the 15th day of the same start month**. To support tight timelines, a "Mutual Plan” is an available tool to ensure the smooth integration of services.

A client is considered “deployed” within 2 business days of receipt of all required information pertinent to the services scoped for each client.

The Partner will be tasked in the Partner Portal for any required information needed for deployment that was not provided upfront.

The Partner will mark tasks as completed and leave a comment for @customersuccess if help is needed.

* All required information listed in the next section “Ongoing Month End - Botkeeper Service Close” must be provided to Botkeeper based on the above timetable to support a first month close

** To support tight timelines, a "Mutual Plan” is available to ensure a smooth onboarding experience

***Dependent on clean-up/ catch-up policy

* To ensure a timely ongoing close, all required information listed in the "Required Information" section must be provided to Botkeeper based on this cutoff date

** Botkeeper may increase the frequency the books are being serviced, but this is not a guarantee

General Ledger (GL) access granted

QBO - Added as a team member to your Firm’s existing QBOA*

Xero - Added as an Advisor with manage user rights in each client’s GL

Bank & Credit Card account setup

Smart Connect (Autopush) or general ledger bank feed (Non-Autopush);or

Transactions provided in an uploadable format**

Access to Bank & Credit Card statements via one of the following:

Smart Connect tool within Client Portal

Manual upload to Partner or Client Portal

Access to statement fetching service (Hubdoc, QBO) granted

Provide Botkeeper with their own (non-shared), read-only credentials***

All 3rd party application access required for Botkeeper to complete services outlined in the scope of services is added and shared via Password Manager (such as Bill.com if AP is scoped)

All tasks in BOS are completed and nothing is outstanding

Partner responsible for completing all work impacting the month-end financial reports

* Other options available

** Monthly entities only - Weekly & Daily entities do not qualify for this item

*** Provided above options have been exhausted

All unpaid bills, client payments or class tracking details received for the processing month on or before the [CLOSE CUTOFF DATE] of the following month will be applied to the actual date of the transaction.

During scoping, the partner will be asked to select “yes” or “no” to the following question:

Does this Client require the previous period to be locked once the month's books are completed?

[Yes] = “Hard Close - Books locked with password”

[No] = “Soft Close - Books locked without password”

Once a task to notify the Partner that the books have been closed is posted to the Partner Portal:

Closing date set by The Future of Bookkeeping with password (4lettersoffirmnameMMYY) in QBO

After a task to notify the Partner that the books have been closed is posted to the Partner Portal:

Any transaction(s) received after the close cutoff date (such as unpaid bills, client payments, class tracking) will carry a posting date of the 1st of the next open month

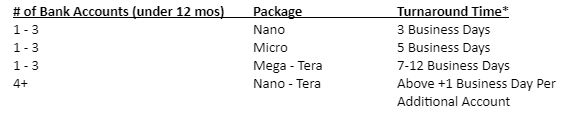

Clean-up: If the bank and credit card accounts are not reconciled through the month prior to the services start date, Partner has the option to sign up for “clean up” services while scoping the client.

Catch-up: If deployment is delayed past the last day of the start month, the months between the start date and the deployment date are “catch-up” and add to the turnaround time of first months' close.

* Multiplied by the number of months clean-up services are required for

** Multiplied by the number of months catch-up services are required for

Bank and credit card feeds for the accounts within scope will be processed at the designated bookkeeping cadence for each client, beginning within 7-10 business days (monthly), 5 business days (weekly) or 2 business days (daily) of being accepted to ongoing services.

Transactions will be coded using a combination of historical data and rules that exist at the Client level, artificial intelligence and machine learning applied to the transaction data and human oversight, including quality control and exceptions management.

Remaining transactions where there is significant doubt on categorization, including any manual checks with no backup available, will be pushed to Transaction Manager in the Client Portal and will be coded to “Uncategorized Income/Expenses” while they await categorization.

A monthly or weekly (weekly/daily bookkeeping cadence) task will be assigned to the main Point of Contact (POC) listed for each client in the Partner Platform to request the POC to review and update transactions pushed to TM that were booked to “Uncategorized Income/Expenses” if any.

Provide required information by the close cutoff date, including:

Categorize transactions within Transaction Manager and/or assign to the client for coding.

Upload check register/images to the Client Portal files tool and tag @bookkeepingteam.

Up to 1 business day will be added to the close due date for each business day overdue.

If the Partner or Client has not categorized in Transaction Manager nor communicated the coding for any uncategorized transaction(s) as of the close due date, the Monthly Closing task with any linked reports, if applicable will be posted to the Partner Portal on the close due date and the Partner will be responsible for any regeneration of reports for the same period thereafter.

Payroll journal entries will be recorded from referencing information from payroll reports uploaded by the Partner or Client via the Portal files tool, or through read-only access provided to pull payroll reports.

If sync between payroll provider and QBO is established, the payroll transactions from the bank feed will be matched with the synced data. If read-only access has been provided, troubleshooting of sync issues will be attempted before escalating to the Partner via Portal task.

All payroll processing functions

Establish and maintain a sync between QBO and payroll provider.

If sync is not possible, upload payroll reports at least monthly, or provide read-only access.

QUICK JUMP TO:

Contact Information | Scope of Services | Monthly Close Timing and Required Information | Catch-up/Clean-up | Transaction Categorization | Payroll Journal Entries | Bank & Credit Card Reconciliation | Standard Monthly Report Package | Partner Communication & Task Management | Perpetual AP Processing | Applying Payments to AR Invoices | Class Department Tracking | Scope Changes | Add-On Services | 1099 Processing

Each bank and credit card account within scope will be reconciled monthly, based on statements provided by the Partner via Smart Connect, manual Client or Partner upload to Partner Platform or by granting access to a statement fetching service.

Paypal is generally considered to be a Merchant Account. However, in cases where Paypal is set up as a regular bank account and all transactions are categorized directly to a revenue or expense account, the Paypal account may be treated as a bank account.

If tying out to sales entries or journal entries are required, that is considered an add-on service and is not included in Basic or Advanced service packages. If faced, those transactions will be treated as uncategorized for the Partner to handle.

Assistance with uncategorized transactions, as per Transaction Categorization protocol.

Reconnection of the bank feeds for any accounts that stop syncing.

Reconnection in Smart Connect or the manual uploading of statements for any accounts that become disconnected.

If an account can not be connected to QBO in the foreseeable future:

Partner or Client will be responsible for uploading a monthly transaction detail report or monthly statement to the Partner or Client Portal files tool or alternatively, granting access to a functioning statement fetching service.

The Client will not be eligible for (or could become ineligible for) weekly / daily bookkeeping cadence.

If an account can not be connected to Smart Connect:

Partner or Client will be responsible for uploading a monthly statement to the Partner or Client Portal files tool or alternatively, granting access to a functioning statement fetching service

A Standard Monthly Report Package PDF will be provided on or before the closing due date, including:

Balance Sheet by Month Comparison [YTD]

Profit and Loss by Month Comparison [YTD]

Statement of Cash Flows for the [Month Day, Year]

(If applicable under Advanced) Profit and Loss by Class/Department/Project [YTD]

Balance Sheet by Month Comparison [YTD]

Profit and Loss by Month Comparison [YTD]

A/R Aging Summary as of [Month Day, Year]

A/P Aging Summary as of [Month Day, Year]

Statement of Cash Flows for the [Month Day, Year]

(If applicable under Advanced) Profit and Loss by Class/Department/Project [YTD]

Amounts will be rounded to the nearest dollar.

Reports will be run based on the Accounting method set in the GL.

If the Partner provides all required information on or before the close cutoff date, or if the Partner has not communicated any required information as of the close due date:

A task will be assigned to the main Point of Contact (POC) within the Partner Portal on or before the close due date to notify the Partner that the books have been closed as per the scope of services. A link to the reports folder in the Files section of the Partner Portal will be included in the task, if applicable.

Partner is responsible for the regeneration of reports for the same period thereafter.

If the Partner opts out of reporting for a client, the task will be created with no reports.

If the Partner provides the required information after the close cutoff date but before the close due date:

Up to 1 business day will be added to the close due date for each business day overdue to close the books and post the portal task with linked reports, if applicable.

The Partner and Client Portal tasks feature will be utilized to communicate regarding deployment and ongoing service related matters.

Partner Portal Default Task Categories and Uses

Note: Tasks posted to the Partner Portal are not visible to Client Portal users when invited in.

Remains as top category

Placeholder category to be used as Partner sees fit

Deployment related tasks

Accounting specific communication/feedback

Notification of financial reports posted to the Partner Portal files folder at month-end

Documentation Requests, where Partner has chosen “Partner” to upload

Recurring bank, credit card, loan or payroll statement upload requests, as applicable

The Partner and Client Portal tasks feature will be utilized to communicate regarding deployment and ongoing service related matters.

Partner Portal Default Task Categories and Uses

Note: Tasks posted to the Partner Portal are not visible to Client Portal users when invited in.

Remains as top category

Placeholder category to be used as Partner sees fit

Deployment related tasks

Accounting-specific communication/feedback

Notification of financial reports posted to the Partner Portal files folder at month-end

Documentation Requests, where Partner has chosen “Partner” to upload

Recurring bank, credit card, loan or payroll statement upload requests, as applicable

Bill.com, QBO, Xero, HubDoc* with Bill.com, QBO or Xero

*HubDoc must be set up to sync with either Bill.com, QBO or Xero to be supported for AP.

All bills should be uploaded to a single location for The Future of Bookkeeping to access, based on the selected AP processing software.

Bill.com = all bills should be uploaded to the Bill.com inbox

HubDoc w/ Bill.com, QBO or Xero = all bills should be uploaded/pulled into HubDoc

QBO or Xero as standalone = all bills should be uploaded to the Client Portal Files folder

Approved types of documents are “processable” and will be included in Weekly AP processing.

“Other” and “archived” folders will be created in the single location bills are being uploaded to.

Any “unprocessable” documents will be filed in the other folder for Partner or Client to action.

Any bills that are processable but are not entered as a bill, will be filed in the archived folder.

| TYPE | TREATMENT | PROCESSABLE? |

|

Unpaid Bills |

|

✅ |

|

Paid or Auto-Paid Bills |

|

✅ |

|

Bills from New Vendors |

|

✅ |

|

Foreign Currency Bills |

|

✅ |

|

Payment confirmations |

|

✅ |

|

Reimbursable expense reports |

|

✅ |

|

Vendor statements |

|

❌ |

|

Multiple bills within a single PDF file |

|

❌ |

|

Expense receipts* |

|

❌ |

|

Tax alerts |

|

❌ |

|

W-9 Forms |

|

❌ |

|

Employee, contractor or internal emails |

|

❌ |

The first weekly processing cycle for each Client will begin 5 business days after the client is accepted into ongoing, then proceed on the selected processing deadline day thereafter.

Weekly processing will include all bills submitted to the single location agreed upon for each Client at least two business days prior to the deadline day.

Bills submitted after the two business day cutoff will be processed the following week.

Any bills that carry a bill date of the prior month that are provided after the monthly close cutoff date of the following month will be posted in accordance with the closing cutoff guidelines at the Client level regarding the posting period (hard close vs. soft close).

At month-end, the AP clearing account will be reconciled, if applicable.

Select a weekly AP deadline day (M-F) for each Client and understand that the cutoff for bills to be included in weekly processing is two business days prior to the deadline day.

Submit or upload bills individually and avoid submitting bills together in one PDF file.

Provide details pertaining to existing or desired approval workflow during scoping, in absence of which will default to approval workflow based on vendor history.

Approve and pay the bills.

Monitor the other folder for unprocessable documents that may need action.

QBO, Bill.com with QBO, and Bill.com with Xero

All bills should be uploaded or emailed-to the AP Bills folder in the Portal using the dedicated email forwarding address set up as “ap+clientname@firm.ai.”

Approved types of documents are “processable” and will be included in AP processing.

“Non-Processable Documents” and “Paid Bills” folders will be created in the Portal.

Any “non-processable” documents will be filed in the Non-Processable Documents folder in the Portal for Partner(s) to action.

Any paid or auto-paid bills that are processable will be filed in the Paid Bills folder in the Portal.

| TYPE | TREATMENT | PORTAL FOLDER | PROCESSABLE? |

|

Unpaid Bills |

|

AP Bills | ✅ |

|

Bills with account or dimension splits |

|

AP Bills | ✅ |

|

Bills from New Vendor |

|

AP Bills | ✅ |

|

Paid or Auto-Paid Bills |

|

Paid Bills | ✅ |

|

Bills with categorization or coding questions |

|

AP Bills | ✅ |

|

Foreign Currency Bills |

|

AP Bills | ✅ |

|

Bill Payment Confirmations |

|

Paid Bills | ✅ |

|

Reimbursable expense reports |

|

AP Bills | ✅ |

|

Emails with no attachment that contain the typical elements of a bill that would allow for entry |

|

AP Bills or Paid Bills | ✅ |

|

Vendor statements |

|

Non-Processable Documents | ❌ |

|

Multiple bills within a single PDF file |

|

AP Bills | ❌ |

|

Expense receipts submitted to Portal |

|

Paid Bills | ❌ |

|

Tax alerts |

|

Non-Processable Documents | ❌ |

|

W-9 Forms |

|

Non-Processable Documents | ❌ |

|

Employee, contractor or internal emails with no attachment that do not contain the typical elements of a bill or are asking accounting questions |

|

Non-Processable Documents | ❌ |

|

Any documentation including bills submitted before the AP go-live date |

|

Non-Processable Documents | ❌ |

Historical AI model training is required if there are documents attached in the connected system (Bill.com or QBO).

There are two training cycles per month that start on the 15th or the last day of the month (or following business day).

The cutoff to provide all required AP deployment information* is 5 business days prior to the next historical training start date.

| Historical Training Start | Cutoff for Submission | Historical Training Completion | BotAP Go-Live |

|

15th of Current Month |

5 Biz Days Prior to Start |

On or Before Last Day of Current Month |

5th Business Day of Next Month |

|

Last Day of Current Month |

5 Biz Days Prior to Start |

On or Before 15th of Next Month |

5 Business Days after the 15th of Next month |

|

To begin the deployment process and get clients into historical training in a timely manner: provide all required AP deployment information* at least 5 calendar days ahead of the next scheduled historical training date (15th or last day of the month). |

|||

General Ledger (GL) access granted

QBO - Added as a team member to your Firm’s existing QBOA

Bill.com - 2 Console-evel users with custom role.

Chart of Account numbers turned [on] with numbers populated.

Tasks assigned in the Portal (requesting action, information or clarification) marked as completed.

Prepaid expenses: Standard is that the majority rules. If the majority of the bill is for a future period, then the entire bill would be categorized to a prepaid account. Alternatively, if the majority of the bill is for a current period, then it would be categorized to the appropriate expense account(s).

Capitalization: Standard capitalization threshold of $2,500 per unit will be used for account categorization purposes unless otherwise indicated.

Bill-level descriptions: Standard is to include the account, policy or customer name or number; if present. If there is no account, policy or customer name or number, the bill-level description may be left blank.

Soft vs. hard close: Any bills that carry a bill date of the prior month that are provided after the monthly close cutoff date of the following month will be posted in accordance with the closing cutoff guidelines at the Client level regarding the posting period (hard close vs. soft close).

Standard for “soft close” clients: All unpaid bills, payments, or dimension tracking details received for the processing month on or before the close cutoff date will carry the actual posting date, even if it applies to the prior period (except as pertains to the prior year).

Standard for “hard close” clients: All unpaid bills, payments, or dimension tracking details received for the processing month on or before the close cutoff date will be applied for the actual date of the transaction. If these details are received after the close cutoff date, they will be processed on the 1st day of the next open month.

Bills will be reviewed, monitored for duplicates, and processed for partner approval.

The first perpetual AP processing cycle for each Client will begin 5 business days after historical training is completed for the client , if applicable. If there is no historical training required, it will begin 5 business days after all required AP deployment information is received.

After the first processing cycle, bills submitted to @firm.ai or uploaded to the Portal will be perpetually processed with a rolling three-business-day turnaround.

High confidence bills will automatically post to Bill.com/QBO once they reach the state of autonomous* processing.

Medium confidence and non-autonomous bills will be reviewed and posted to Bill.com/QBO, based on the rolling three-business-day turnaround.

Low confidence bills, including bills requiring further assistance and those for new vendors, will be surfaced to the Partner during the review process via a task in the Portal and must be approved by the Partner before being posted to Bill.com/QBO. The Partner will also have the option to reject the bill(s) with comment. Rejected bills will be archived and will not be posted to Bill.com/QBO.

*Autonomous processing is activated for a bill once the AI modeling and machine learning have reached a consistent 90% or higher confidence rating.

There will be a maximum of one Portal task per client per day to alert the partner if bill(s) need attention prior to being posted to Bill.com/QBO.

Once a vendor’s bill is posted to Bill.com, the client’s Bill.com “default approval” setting will be applied. If there is not at least one “default approver” in Bill.com, the approvers will be based on Bill.com vendor history, and thus, bills with no vendor history will be posted to Bill.com as “unassigned.”

Categorization and dimension changes within the connected system (Bill.com or QBO) after posting are caught by the ML engines during its twice-monthly training and applied to future predictions. Additionally, the “Partner approval before posting” workflow surfaces the most likely to be changed/least confident bills (such as new vendors, items that have been capitalized, bills with inconsistent history) and allows for any categorization changes prior to posting the bill(s) into Bill.com or QBO. If, however, the partner makes any changes to the categorization or dimension of a bill after being posted to Bill.com/QBO, they should notify @Accountant via a Custom Request task in the Portal to increase visibility of the correction.

At month-end, the AP clearing account will be reconciled, if applicable.

Ensure at least 1 “default approver” is set up in the Client’s Bill.com account, in the absence of which it will default to the approval workflow based on vendor history.

Provide all required AP deployment documentation 5 business days prior to the next historical training start date.

Ensure proper client/vendor bill submission to be emailed to ap+clientname@firm.ai or uploaded to the AP Bills folder within the Portal and monitor any legacy systems as needed.

Submit or upload bills individually and avoid submitting different bills together in one PDF file.

Review and approve any bills raised for partner approval via a Portal task, including making any categorization changes before approving the bill(s). Please see the chart below that details the different reasons that may arise for bills to be sent to approval. After approving (or rejecting the bills, return to the Portal to mark the task as complete to ensure the bill(s) get posted to Bill.com or QBO.

Notify @accountant in the Portal via a custom request task if any categorization or dimension changes are made in the connected system (Bill.com/QBO) for maximum visibility to those changes

Manage and maintain all payment, approval, or rejection activities within Bill.com, QBO or other systems integrated with QBO.

Review and action non-processable documents in the “Non-Processable Documents” folder in the Portal as needed:

Please reference the chart above to determine non-processable vs processable documents.

| Approval Request | Description | Partner Action |

|

New vendor added |

|

|

|

New vendor added - need valid email |

|

|

|

Categorization assistance requested |

|

|

|

Purchase over capitalization threshold |

|

|

|

Confirmation of email processed as bill |

|

|

|

Potential duplication |

|

|

|

Missing documentation |

|

|

This service will be rendered at the same Client bookkeeping frequency selected during scoping. Partner will indicate during scoping whether payment and deposit details will be uploaded by the Partner or by the Client, which will dictate which Portal the AR folder and AR task reminder is posted to (Partner Portal or Client Portal).

Details uploaded to portal including deposit date and amount in file name.

QBO merchant center for QBO payments received via Intuit.

Any 1:1 matches between a deposit and an invoice.

Partner or Client will upload payment and deposit details to the respective AR Payment Details folder using standard file naming convention including deposit date and amount.

Partner or Client will not need to upload payment and deposit details if one of the following scenarios exists:

Information is available within QBO merchant center for payments received via Intuit

There will almost always be a 1:1 match between a deposit and an invoice

Partner or Client will review tasks posted to the Portal (throughout the month, immediately after transaction processing) or transactions pushed to Transaction Manager (after the month ends) regarding any unknown payments/deposits and provide additional information prior to the close cutoff date.

Classes or departments will be assigned to transactions per the agreed upon bookkeeping cadence for that Client, based on the below criteria (listed in order of prioritization):

Written instructions on invoice or bill

List provided by Partner

Historical data

If a transaction can not be allocated to a class or department based on any of the above criteria, the transaction will fall to the "unassigned" class, department, project or job for the Partners attention in the GL and push to Transaction Manager (TM).

A monthly or weekly (weekly/daily bookkeeping cadence) task will be assigned to the Partner within the Portal to review and update unassigned transactions pushed to TM (combined with the regular task generated for all TM transactions that month/week).

Provide rules for each class or department during scoping and assign a task to @bookkeepingteam in the portal to communicate rules for any new classes or departments.

All rules provided should support a 1:1 relationship. With the exception of Payroll, a single transaction will not be split between multiple classes or departments.

If a third party system is used and information without classes/department are being synced, the Partner is responsible for reclassing those transactions.

Review and update unassigned transactions in Transaction Manager by the close cutoff date each month, to ensure the most complete monthly reports by class or department.

Transactions classified after the close cutoff date may lead to a delay in the close due date. If the monthly reports were already posted or in process of being prepared, Partner may need to re-run reports for updated information. See reporting section for more info on timing of reports.

Partners can make changes to scope (add-on services, add/remove bank accounts, adjust add-on service requirements) directly in the platform through the Scoping Tool.

Common scope changes after a client is accepted into ongoing services:

Add or remove Bank or Credit Card account

Upgrade from Basic to Advanced Services (Class & Department Tracking, Weekly AP Processing and/or Applying Payments to AR Invoices)

Add-on Services, after the first 2 monthly closes

Step-by-step instructions for the Scoping Tool can be found here:

Step-by-step directions on using Botkeeper's Scoping Tool for Legacy Platform

Step-by-step directions on using Botkeeper's Scoping Tool for BOS

Please reference the Redeployment Required Info doc for add-on service requirements.

Once your changes are deployed, you will see any required tasks in the portal.

Please note the following services' start dates when scoping clients for ongoing services:

All services except for Weekly AP:

Follows the first monthly close policy - all required information should be provided no later than 2 business days prior to the 15th day of the same start month

Services will begin as follows:

Monthly: within 7-10 business days of acceptance into ongoing

Weekly: within 5 business days of acceptance into ongoing

Daily: within 2 business days of acceptance into ongoing

Weekly AP:

Follows the weekly AP processing policy - the first weekly processing cycle for each Client will begin 5 business days after the additional service is accepted into ongoing, then proceed on the selected processing deadline day of the following week.

Thus, all required information should be confirmed by @customersuccess no later than 7 business days prior to the desired first processing day (+2 days for acceptance).

Journals & Schedules

Bundle of 5 Simple Journals

Basic Schedule Maintenance

Vendor Management

QBO W-9 Requests

Reporting

One-Time Addition to Management Report

Enhanced Ongoing Report Support

Job/Project tracking

Invoicing

Std. Preparation & Sending

3rd Party Applications

Point of Sales Entries / Reconciliation

Credit Card Merchant Entries Reconciliation

Inventory Adjustments / Reconciliation

Migration QBD to QBO, [other system] to QBO (conversion balances and lists only)

Clean-up / Catch-up

Custom Dashboards

Check out our Xero Botkeeper Standard Operating Procedures for your XERO clients!

Let’s start with a truth bomb: You pay your team to perform—but are you rewarding them for the firm’s performance?

...

Let’s be real: budgeting in 2026 is a survival skill, not a nice-to-have. The world your clients are operating in...